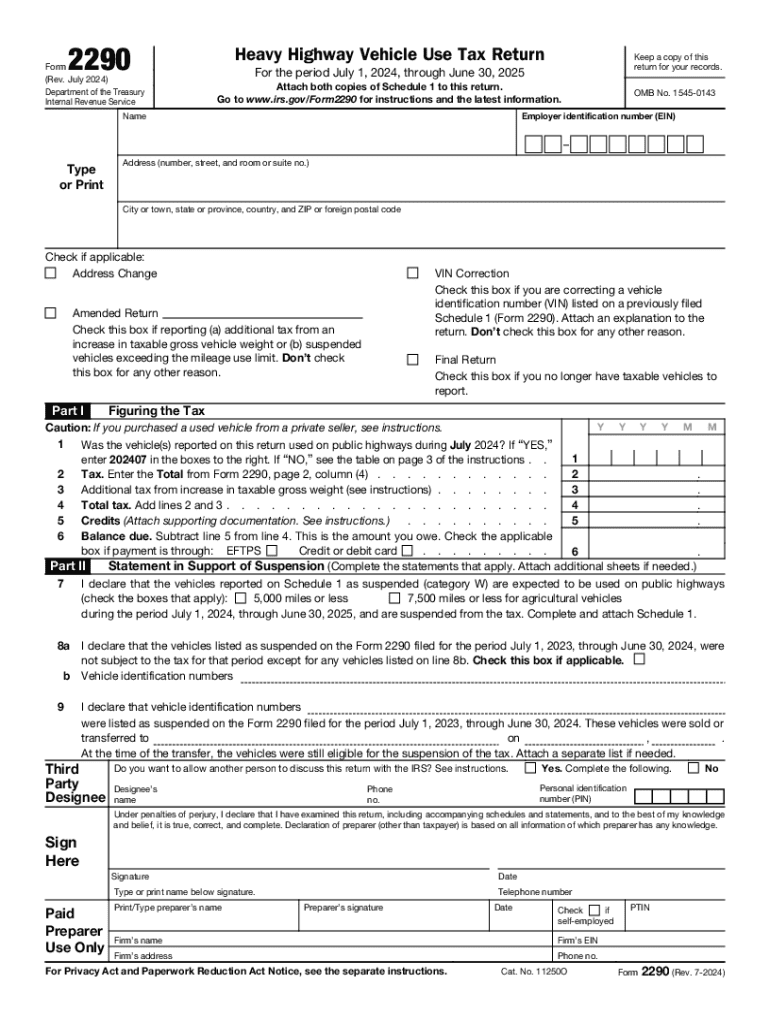

Who needs an IRS Form 2290?

Form 2290 is a US Internal Revenue Service standard tax form used for filing a heavy highway trucks use tax return.

What is the IRS Form 2290 for?

There is a yearly based tax on heavy vehicles used in the territory of the US. One copy of this form should be submitted to the IRS for each heavy vehicle on the go. The information provided is to be used by the IRS for paid taxes accounting and their verification.

Is the IRS Form 2290 accompanied by other forms?

Both copies of Schedule 1 should accompany this form 2990 which requires applicant to indicate the VIN number of each truck from the report.

When is IRS Form 2290 due?

For trucks first used on a highway during July, this form should be filed and the tax paid between July, 1 and August, 31. In case a vehicle is first used on a public highway after July of the current year, you should check the table on the IRS site for the due dates1.

How do I fill out IRS Form 2290?

Provide your personal information including name, address and employer identification number. You must determine a tax amount in Part I using the Tax Computation table from the second page of the form. If you have a truck that was used under the minimum to be taxed, indicate it in Part II of this form. Your tax may not be taxed or may be limited by how much they can be taxed. Complete Part II certifying you have suspended vehicles if applicable to your trucks. Otherwise, continue to the final boxes and certify your form 2290. That’s it, you have done your 2990.

Where do I send IRS Form 2290?

A copy of this form should be kept for your personal records. The original should be directed to the IRS Office.

1check the link — https://www.irs.gov/businesses/small-businesses-self-employed/when-form-2290-taxes-are-due